Your questions answered.

+ What’s the difference between a Traditional and an Ethical Investor?

Traditional investors are solely focused on financial returns. The traditional investor might simply not consider the environmental and social impact of their investment, or they might believe that doing so could increase their risk and/or reduce their return. For the traditional investor, the impact their money makes on the real world doesn’t matter. Ethical investors (also known as ‘responsible investors’) want to make money AND make a difference. Where traditional investors focus on the two dimensions of risk and return, responsible investors add impact to the mix – creating a shift from two-dimensional to three-dimensional investment.

+ What are the main categories of ethical investment?

What is ESG Integration?

ESG integration is the consideration of Environmental, Social and Governance factors when making investment decisions. It’s the first step along the ethical investing spectrum. With ESG integration, fund managers don’t specifically exclude companies to satisfy investor preferences. Instead, they take ESG information into account in an attempt to enhance risk adjusted returns. Most NZ-based fund managers now say they apply ESG integration.

What is Negative Screening?

When ethical managed funds are selecting which companies to invest into, many use a ‘negative screening’ process. This process specifically seeks to exclude companies or industries assessed as having a negative impact on the environment or society (e.g. through high carbon emissions or selling tobacco). The remaining companies are usually then allocated proportional to their market weight. Most ethical funds will detail these exclusion criteria and the thresholds at which they apply. The criteria range in breadth and depth.

What is Positive Screening?

Many ethical funds not only exclude investments with the most significant negative impact – they go a step further, and also include an overweight allocation to firms deemed ‘best-in-class’ ethical leaders. These leaders have a more positive impact (or less negative impact) than their industry peers. For example, an electricity provider using predominantly hydro power will get a higher weight than one using coal burners.

What is Sustainability Themed Investment?

Rather than excluding some companies and overweighting others, sustainability themed investing instead specifically selects companies who are providing solutions to sustainability challenges. For example, environmental solutions such as cleaner energy, environmental services, resource efficiency, sustainable transport, and water management. Or social solutions including education, health, safety and wellbeing.

What is Impact Investing?

Impact investing is investing with the goal of delivering measurable positive environmental or social impact, as well as financial returns. While you could say impact relates to all types of responsible investing, it’s most strongly associated with Sustainability Themed Investment and specific category of ‘Impact Investing’. In this context, Impact Investing can be defined as targeted investments – often to smaller, unlisted initiatives aimed at solving social or environmental problems. These targeted investments can also include community investing, where capital is specifically directed to traditionally underserved individuals or communities.

+ Can I make money and make a difference?

Many investors and business leaders now believe that consideration of ethical issues doesn’t compromise financial performance. In fact, many believe the opposite to be true; that ethical investing can often increase return and reduce risk.

They cite factors such as attracting, retaining and enhancing the productivity of employees; improving customer sales and loyalty; increasing supplier commitment; contributing to environmental sustainability; reducing legislative demands; and strengthening community and Government relations. They believe that management quality can be improved, and when combined with enhanced relationships with stakeholders, this can result in improved financial performance for shareholders.

The idea that there is necessarily a trade-off between stakeholder-oriented business and shareholder financial rewards has been shown to be a myth. Through responsible investing, you can indeed do well and do good.

“The evidence is incredibly strong. Investors no longer need to sacrifice returns to do the right thing. That old myth is dead and buried.”

– Simon O’Connor, CEO of RIAA (Responsible Investment Association Australasia)

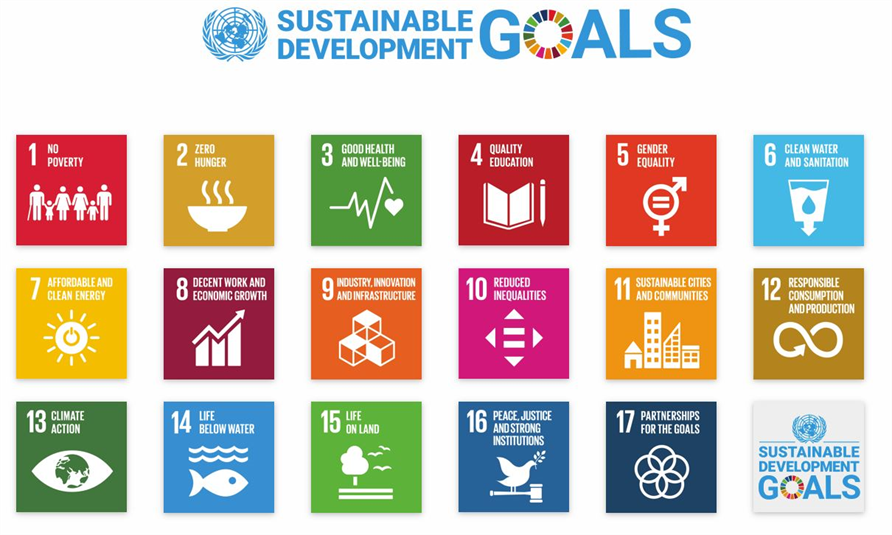

+ What are the UN Sustainable Development Goals?

Many ethical investors aim to make a difference by helping achieve the United Nation’s Sustainable Development Goals (SDGs). Set out in ‘Transforming Our World: the 2030 Agenda for Sustainable Development’, the 17 SDGs are a benchmark to measure impact and progress against. The vision includes a target to limit climate change to 1.5 degrees of global warming above pre-industrial levels.

The UN rightly highlights that the world’s money matters, and that the necessary progress won’t happen without the transformation from investment and ‘business as usual’ to a far higher level of ethics and sustainability.

+ What are the different types of investment risk?

Risk is a natural part of the investment landscape, and every investment comes with a different level of it. Some investments, like property and shares, can have a high risk attached. Others, like bonds or cash, can come with a relatively low risk. In general terms, higher risk investments see more ups and downs – so you can expect to see more frequent (and larger) rises and falls in your returns. Lower risk investments see fewer ups and downs, but also come with the possibility of lower returns.

The Financial Markets Authority explains the types of investment risks below:

- Interest rate risk: when interest rates rise after you lock in your money, meaning you don't earn as much on your money as you would have if you'd invested at the higher rate.

- Liquidity risk: there might not be buyers interested in your investment when you want to sell.

- Credit risk: the organisation may not be able to repay its debts, and you might lose your money.

- Economic risk: the economy may or may not be doing well, which could affect the value of your investment.

- Industry risk: risks affecting a particular industry, like shortages of raw materials or changes in consumer preferences.

- Currency risk: your investment is affected by changes in the value of the New Zealand dollar.

- Inflation risk: your investment doesn't earn enough to keep up with inflation.

The FMA goes on to say… “Taking on risk is what you’re getting paid for, through investment returns. When you take on more risk, you should get paid more in return. Risk is only bad if you’ve accepted too much or too little for your investment goal; and/or you’re not being paid enough in return to compensate you for the risk you’ve accepted.”

You can help manage risk by building a diverse investment portfolio, and having a clear understanding of your responsible investment goals and risk profile.

+ How will Money Matters assess my risk profile?

Determining your risk profile is a key step in your ethical investment plan. Risk and return can be seen as two sides of the investment coin, and you need to know where you sit on the risk/return spectrum. As your financial adviser, Rodger will talk this through with you and explain the subtleties involved in this important decision. Before or during your meeting with Rodger you will complete a risk profile questionnaire.

There are a number of factors to be considered in determining your risk profile. One is the period of time for which you are planning to invest, which should be matched to your goals. Longer-term goals, such as funding 20 years plus of retirement expenditure, are generally best matched with a portfolio that includes a significant allocation to shares, as these offer the possibility of higher expected returns but with more ups and downs.

Another key issue is your emotional comfort level with the ups and downs of the share market. This is sometimes referred to as ‘the sleep test’. Would you be able to sleep at night if your portfolio experienced a substantial negative return, or even knowing that it could? Your response may influence your decision on how much to allocate to shares.

During your meeting, Rodger will discuss the main asset classes – cash, fixed interest, property and shares – and especially their risk and return characteristics. Together, you can then decide upon your asset allocation, or to what extent these asset classes will be included within your responsible investment portfolio.

+ How does Money Matters decide on asset allocation?

Asset allocation involves choosing between cash, fixed interest, property and share market investments – not only in New Zealand but also internationally. Rodger will explain key principles for a disciplined approach to allocating your assets, and show you how the Money Matters ethical investment approach applies these to help you avoid the traps of market emotion and market timing.

Taking a disciplined approach to investment is as essential to the performance of your portfolio as a well maintained engine is to the performance of your car. It helps you ride out adverse fluctuations in the market and ensure maximum mileage for your money. The Money Matters' approach is based on creating a well-diversified portfolio on which the assets are allocated in a way that reflects your goals and risk profile.

A long-term or strategic asset allocation (percentage weighting) for each of the asset classes (cash, fixed interest, property and shares) provides guidance for investing.

History shows that over time investors have a greater chance of generally meeting their objectives if they select an appropriate mix of investments, have a realistic time horizon and are patient. This means that they need to be prepared to accept ‘bumps’ in the return on their portfolio, which will occur from time to time.

Investors who opt for a high-growth strategy can expect to experience a rougher road with high volatility in the short term. Longer term, however, it is expected (but not guaranteed!) that if their investment is maintained for the appropriate period in a well-diversified portfolio with quality assets, managed by leading investment specialists, the investor will be rewarded with higher returns for tolerating this additional risk.

+ What are managed funds, and why does Money Matters recommend them?

Managed funds are a medium for indirect investment. They are a pool of money from many investors, managed by a team of professionals on their behalf.

At Money Matters, we believe managed funds are a superior option to investing directly. This is because, compared with direct investment, managed funds come with many benefits, including:

• More Specialist Professional Management

Through managed funds investors can gain access to a wider range of experienced and qualified professionals who specialise in the selection and maintenance of particular investments.

• Greater Diversification and Spreading of Risk

Investors obtain a much wider spread of risk than most could achieve on their own. Investors buy into a wider portfolio of investments, which spreads the risk and can reduce price fluctuations.

• Access to More Investment Opportunities

Through managed funds, investors can invest in many multi-million dollar investments that they otherwise wouldn’t have the financial capacity to make. These larger investments often represent assets of superior quality purchased in strategic parcels, which can offer far greater returns than those available from smaller sums invested

+ How are managed funds researched?

When creating a rating for a fund, specialist managed funds research firms evaluate factors such as:

- People & resources

- Investment philosophy (style)

- Research process

- Portfolio construction

- Risk management

- Historical performance data

- Risk and return metrics

- Consistency of performance

+ What issues are considered in ethical managed funds research?

Managed fund research firms consider conventional managed fund research criteria, as well as specific ethical and investment considerations. This includes issues such as…

- To what extent does the fund adhere to an ESG (Environmental, Social and Governance) charter?

- What is the level of negative screening of excluded industries?

- Does the fund tolerate fuel investment, coal investment and ‘big mining tolerance’?

- What is the extent of positive screening of companies based on ethical investment criteria?

- To what extent does the fund actively engage with companies on ethical investment issues?

- Is the fund a UNPRI (United Nations Principles for Responsible Investment) signatory, and if so what is their rating?

- Does the fund manager monitor the portfolio’s carbon footprint?

- Does the fund manager employ dedicated ethical investment personnel?

“We have been invested with Money Matters for more than 25 years and during this time we have found Rodger has taken care of our Portfolio with an extremely high degree of integrity, professionalism and skill, this all done with honest sound advice. Also, we have always had a warm and comfortable relationship with Rodger. We strongly recommend Money Matters to anyone wanting to invest in a well-managed Diversified Ethical Portfolio.”

– Tim and Gaye B.

Ready to make your money matter?

Achieving your goals starts with expert guidance.

Schedule an "Ask Anything" session with Dr Rodger Spiller – a no obligation conversation that will help you determine if Money Matters is the right match for you.