Shifting the Needle on Extreme Weather Events

As an investor, being aware of risks that could impact your outcomes is essential. Ethical investors are uniquely positioned to not only be aware of risks, but play a role in mitigating them through the choices they make with their money.

So what are the risks rising to the surface for the years ahead?

Climate change, specifically extreme weather events, is emerging as a front runner.

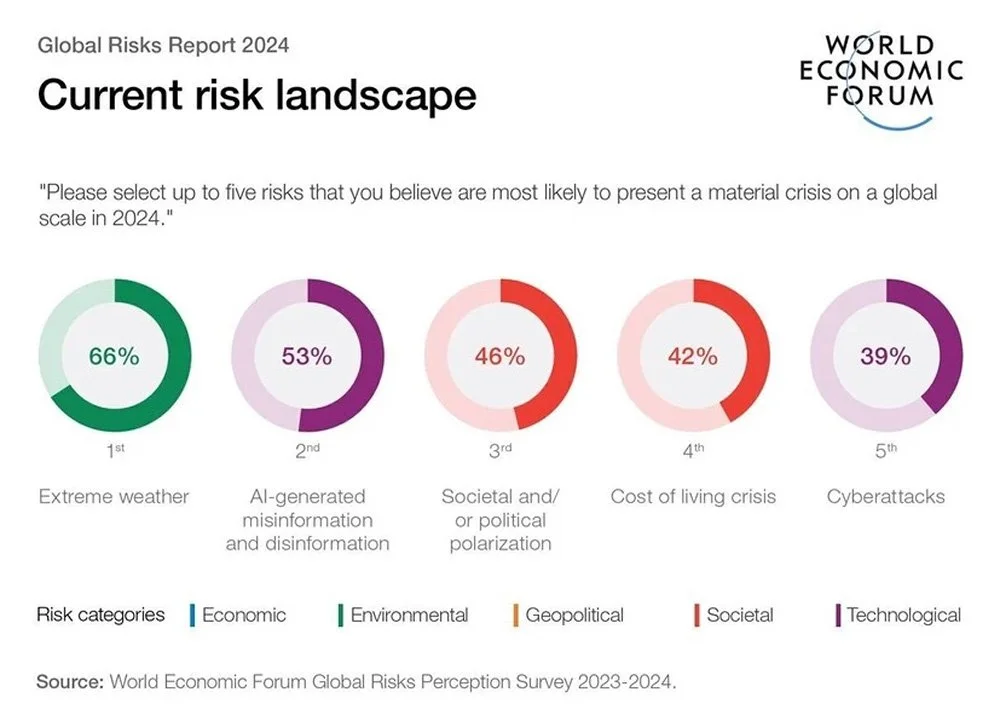

Extreme weather events have been identified as a top risk by World Economic Forum experts in their Global Risks Report 2024.

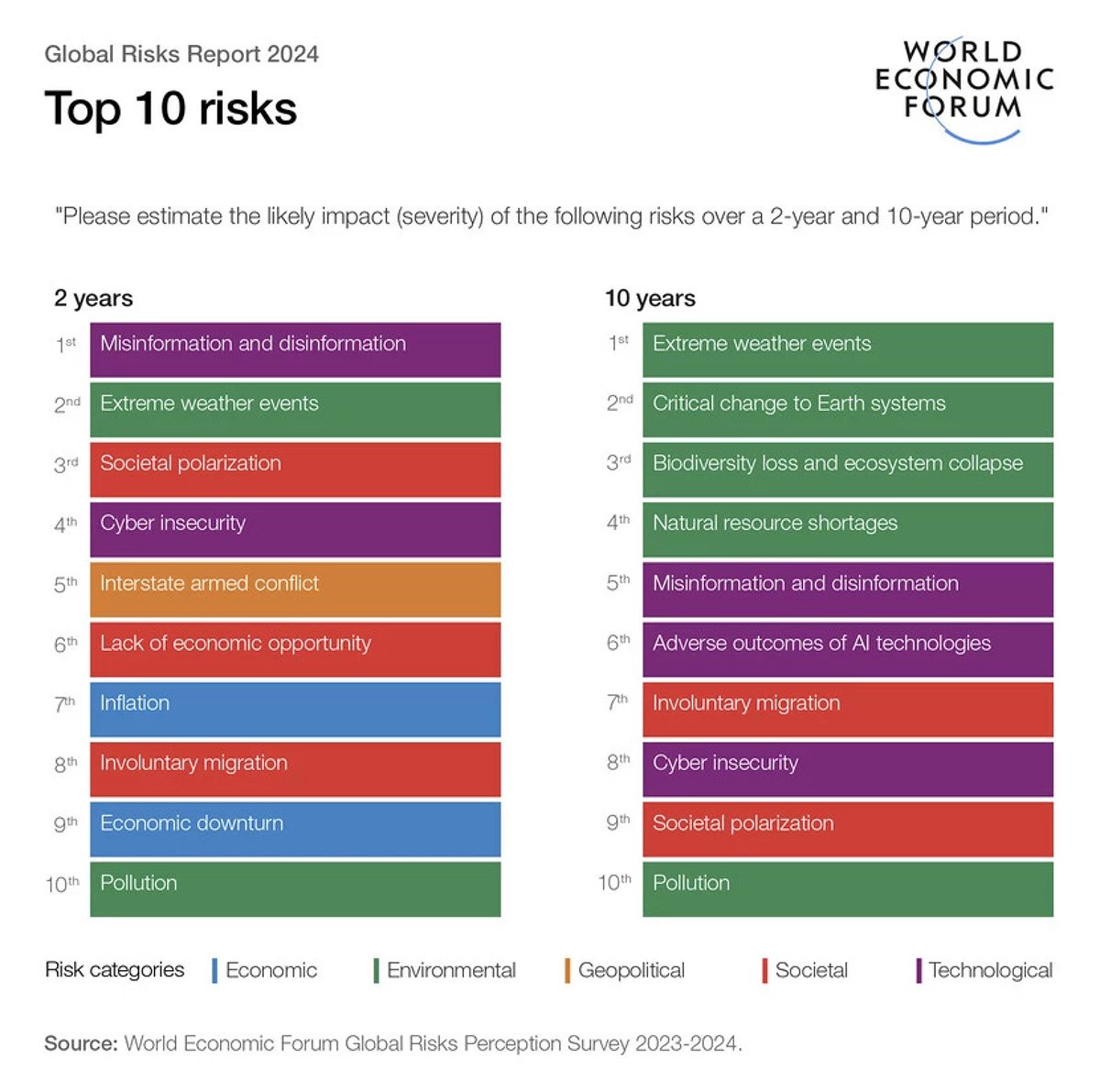

Extreme weather has been given a risk ranking of second on the 2-year horizon and first on the 10-year horizon – 10 years being a more relevant timeframe for longer term investors.

The Global Risks Report delves further into the risks, possible solutions and potential for mitigation of this and other risks. Here’s a summary of what the experts had to say.

Extreme weather events, critical change to Earth systems, and biodiversity loss and ecosystem collapse are the top three long-term risks featured in the Global Risks Report in 2024. These issues are interrelated and mutually reinforcing.

The first priority solution is faster emissions reduction and credible steps by all actors in our economic system to accelerate the speed and scale of a clean transition.

Reducing human emissions is the swiftest lever to postpone or avoid critical changes to Earth systems. (Once climate tipping points have been reached, Earth’s natural systems reinforce changes and so delaying these for as long as possible will give our civilization time to develop appropriate adaptation and resilience strategies.)

Effective adaption to coming changes is the second priority for addressing systemic collapse from environmental risk…..an ecosystem of interconnected solutions is needed to address threats to human life, landscapes and property.

Solutions are already available: For example, innovations from African farmers, experienced in drought and flood management, will be crucial to quality of European crops. Grassroots innovation in managing the relocation of Arctic communities, who are the canaries in the coal mine of the climate disaster, can be harnessed to understand the policy safeguard and most effective approaches to handling forced migration from sea-level rise.

The report is also clear on the role of optimism in weathering the risks and changes ahead:

We must recognize the full scale of the risk, but maintain the optimism that we can and will respond in a way to avoid and mitigate the worst risks from occurring.

Gill Einhorn, Head of Innovation and Transformation, Centre for Nature and Climate, World Economic Forum, sums this up perfectly: “What is needed is a mindset that recognizes the full scale of the risk, while maintaining the optimism that we can and will respond in a way to avoid and mitigate the worst risks from occurring.”

As an investor, it can be easy to feel ‘swamped’ by the scale of the problems the world faces and powerless in the face of extreme weather events ahead.

At Money Matters we want to reinforce the report’s conclusion that “the efforts of single entities can make the world a safer place”. Each person’s individual ethical investment – including yours – can contribute to shifting the needle.

In the words of the report itself, “The actions of individual citizens, companies and countries – while perhaps insignificant on their own – can move the needle on global risk reduction if they reach a critical mass.”